Life insurance trusts are a powerful estate planning tool that can help you protect your loved ones and reduce estate taxes. By placing your life insurance policy in a trust, you can ensure that the proceeds are used according to your wishes, avoid probate, and potentially shield your estate from hefty taxes. In this guide, we’ll explore how life insurance trusts work, their benefits, and why they can be a crucial part of your long-term financial strategy.

#1 What Is a Life Insurance Trust?

A life insurance trust is a powerful tool for estate planning, allowing you to maintain control over your life insurance policies and the proceeds from them. By placing your life insurance policy into an irrevocable life insurance trust, you can reduce or eliminate estate taxes, ensuring more of your estate goes to your loved ones.

#2 What Are Estate Taxes?

Estate taxes are taxes levied on the total value of your estate after your death. They are separate from probate expenses and final income taxes. Estate tax rates can be steep, often ranging from 45% to 55%. Without careful planning, your estate could be forced to sell assets to pay these taxes. However, using tools like a life insurance trust, you can reduce or even eliminate these taxes.

#3 Who Needs to Pay Estate Taxes?

Federal estate taxes are applicable if the value of your estate exceeds the federal exemption limit, which is set by Congress. The exemption amount changes over time, and some states may have their own estate or inheritance taxes. Proper estate tax planning can help minimize these costs, particularly with strategies like transferring life insurance policies into a trust.

#4 How Life Insurance Affects Your Estate Taxes

Life insurance policies, especially if you have control over them (such as the ability to borrow against them or change beneficiaries), are considered part of your taxable estate. This can increase your estate tax burden. However, if the policy is owned by an irrevocable life insurance trust, it is not counted as part of your estate, which can substantially reduce your estate taxes.

#5 How Does a Life Insurance Trust Reduce Estate Taxes?

By placing your life insurance policy in an irrevocable life insurance trust, the policy is no longer part of your estate. The trust owns the policy, and since you do not have "incidents of ownership," the life insurance proceeds will not be included in your estate when you pass away. This reduces your estate tax liability.

#6 Additional Benefits of Life Insurance Trusts for Estate Taxes

Even if your estate will still be subject to taxes, a life insurance trust can help cover these costs without the need to sell assets. The trust can be used to purchase additional life insurance, which will not be included in your taxable estate. This ensures that your loved ones receive the full benefit of your estate, without the burden of estate taxes.

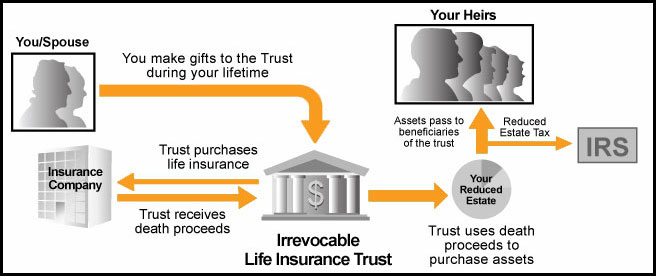

#7 The Mechanics of an Irrevocable Life Insurance Trust

An irrevocable life insurance trust (ILIT) consists of three key parties: the grantor (you), the trustee, and the beneficiaries. The trustee manages the trust and ensures that the life insurance policy is properly administered. Upon your death, the trustee will use the proceeds from the life insurance policy to pay estate taxes and other expenses, and then distribute the remaining funds to the beneficiaries.

#8 Who Should Be the Trustee?

While you can’t be your own trustee if you want to reap the full tax benefits, you can select someone you trust—such as your spouse or an adult child. Many people choose a corporate trustee, like a bank or trust company, for their experience in handling life insurance trusts and ensuring everything is properly managed.

#9 How Does a Life Insurance Trust Provide Control?

One of the major advantages of a life insurance trust is that it allows you to retain control over how the proceeds are used. For instance, the trustee can use the proceeds to pay taxes, make loans, or purchase assets from your estate. This provides peace of mind, knowing that your family’s financial future is secure, and the money is protected from creditors.

#10 Who Can Benefit from a Life Insurance Trust?

You can name anyone as a beneficiary of your life insurance trust, including your spouse, children, grandchildren, or even charitable organizations. The flexibility of choosing your beneficiaries allows you to tailor the distribution of assets according to your wishes.

#11 How to Fund a Life Insurance Trust

Funding your life insurance trust typically involves transferring money to the trust to pay for premiums. Annual gifts can be made tax-free up to a limit set by the IRS, and if you give more than that, it applies to your estate tax exemption.

#12 Timing of Transferring Life Insurance to a Trust

To avoid the three-year rule, it’s important to transfer life insurance policies into an irrevocable life insurance trust well in advance of your death. If you pass away within three years of transferring the policy, the life insurance proceeds will still be included in your estate for tax purposes.

#13 Should You Seek Professional Help?

Given the complexity of life insurance trusts and estate tax laws, it is advisable to work with an experienced estate planning attorney, CPA, or financial advisor. A professional can help you create a plan that fits your unique needs and ensures that your estate is structured to minimize tax liability.

Conclusion: Benefits of Using a Life Insurance Trust for Estate Planning

A life insurance trust offers several benefits in estate planning:

- Immediate funds to cover estate taxes and other expenses after your death

- Reduction in estate taxes by removing the insurance policy from your estate

- Control over how insurance proceeds are distributed to beneficiaries

- Protection of assets from probate and creditors

For those with substantial estates, a life insurance trust can be an invaluable strategy for preserving wealth for future generations while minimizing the impact of estate taxes.